To all of you now in Bali.

It is time to prepare for the worst and

hope for the best regarding Bali's pending volcanic eruption.

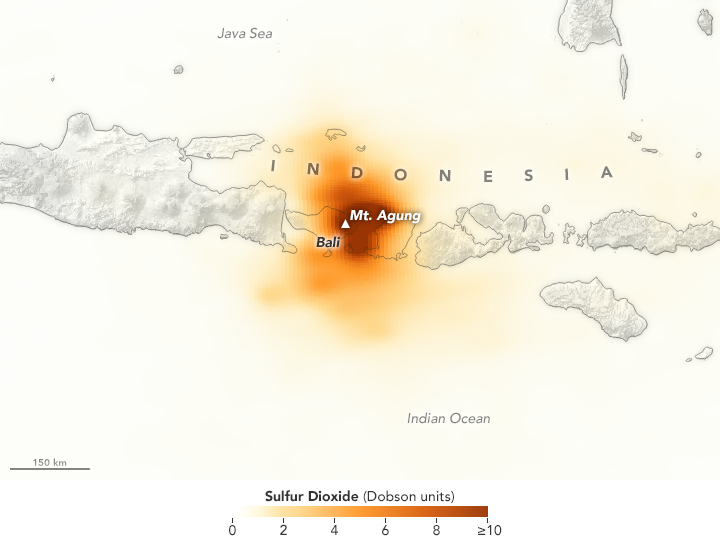

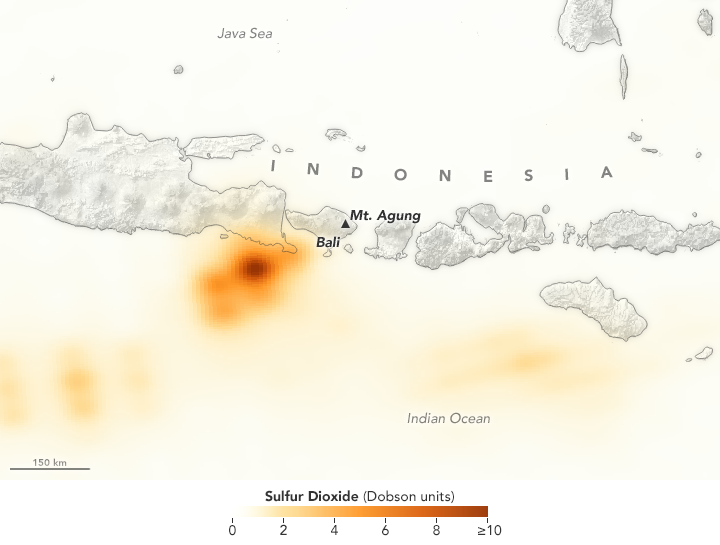

So far the worst we have seen from the ongoing volcanic activity

is some dust over much of Bali and lahar in a few rivers, which is volcanic

particles mixed with water coming down the rivers.

So far the worst we have seen from the ongoing volcanic activity

is some dust over much of Bali and lahar in a few rivers, which is volcanic

particles mixed with water coming down the rivers.

In a perfect world, this would be all that would happen, but it's

time for a reality check.

The experts and history dictates that most likely we have a very

strong possibility of a major eruption occurring in the near future.

|

| Deadly Mount Agung Eruption 1963 |

“Very strong possibility of a major eruption occurring in

the near future.”

My fellow hoteliers and business owners are probably furious at

these words but “it's better to be safe than sorry”.

Xmas may Be A Write Off:

A few more days of the airport being closed and we can pretty well

write off Christmas and New Years.

You can always make more money, but if you don't prepare for a

major eruption you may lose more than money, you maylose your health or even your life.

Don’t

Shoot the Messenger:

Please don't shoot the messenger but I personally have gone into

full on, prepare for the worst scenario, as of this morning with my lovely wife

Azizah who is out shopping for things

that we may need if the worse case scenario, a major eruption takes place.

Are we in danger of being swallowed up by lava or a pryocystic

flow traveling at 1,000 km/h? Not likely unless we are within the 10 to 12 km

perimeter that the government has set as a danger zone.

Are we likely to get a substantial amount of volcanic dust? Yes!

The question is how much dust and how will it affect our daily lives.

You can go to the Internet as I did and find article are after

article of what will happen.

Using common sense the worst-case scenario is

that when this happens, we may all be forced to stay in our homes or hotel

rooms, at least for a few days or even a week.

“May all

be forced to stay in our homes or hotel rooms at least for a few days or even a

week”

My biggest concern is a loss of electric power.

Those of who have lived

as long as I have in Bali for 21 years know that power can be knocked out very

easily with storm conditions.

With my engineering education I can tell you that

the electric power on parts of Bali will most likely be knocked out or have

to shut down because they will not be able to operate with intense ash in the

air.

When that happens forget about air-conditioning, fans, water pumps, pool pumps and all the other

luxuries that we have in modern-day life.

There is also a good chance we can forget about Internet, mobile

communications and even possibly local telephone communications.

On Your Own:

In other words, you may be on your own. If the stores don't have

electricity and only a limited amount of fuel to run generators after a few

days they may have to shut their doors which may cause vandalism and pilferage

of the stores.

Even of the stores do remain open taking a motorcycle or your your

car there may be near impossible because engines need clean air to operate.

How to Prepare For The Worst:

So how do you prepare?It's quite simple. You make sure you

have the clothing, breathing apparatus ,water and the food to survive for

several weeks until things get back to normal.

Look what happened in the American satellite state of Puerto Rico

after a hurricane hit a modern island. It was brought to its knees with people

relying on mountain water and in many cases polluted water to wash their

clothes and their dishes with.

So below is an emergency list that I put together this morning and

will be in my home at the end of the afternoon ready for the worst case

scenario.

Pray For the Best:

Then I as everybody else will pray that nothing drastic happens,

but it if does at least my family will not be scrounging around looking for

food and water.

Don’t Kill The Messenger:

Please don't kill the messenger I know many of you don't like me

putting so bluntly what the worst-case scenario may look like, but if I save

anybody from hardship or even loss of life it was worth it.

As a former yacht charter Capt. who survived two cyclones and many

crisis is my long life I can tell you It’s always “better to be safe than sorry”

A.

Emergency Survival Food list

_1. Grocery Store & Bulk Foods

• Rice

• Legumes: Pinto beans, Black beans, split peas, etc.

• Oatmeal, cornmeal

• Canned Fruits (lots), various canned vegetables & canned tomatoes, soups & stew.

• Milk: Canned/Evaporated, powdered, sweetened/condensed

• Eggs, powdered

• Peanut Butter, nuts, popcorn

• Dehydrated fruits & vegetables

• Jerky, Trail Mix

• Wasa Multigrain flat bread, Graham crackers, Saltines, etc.

• Chocolate, cocoa, Tang, punch

• Honey, syrup,white sugar, brown sugar

• Spices (the basics: salt, pepper, cinnamon, garlic, onion salt, etc,)

• Soy Sauce, vinegar, bouillon cubes or granules

• Canned Meats: Tuna, chicken, Spam, ham, etc.

• Cooking Oil & spray

• Baking Supplies & flour, yeast, packaged muffin mix & pancake mix

• Coffee, tea

• Vitamins, Minerals & Supplements

• Water: Quickly figure 1 gallon drinking water/person/day. As cases of bottled water, or from a filer unit like the ‘Big Berkey’ (Google it), a 55 gallon ‘rain barrel prefilled with public utility water, water purification with household bleach or boiling. Don’t store everything else first and skip the water. You can live a month without food, but only about 3 days without water…start out with the proper priorities.

to all you

GETTYKim Jong-Un may be planning a shock Christmas missile blast

GETTYKim Jong-Un may be planning a shock Christmas missile blast GETTYSpeculation has been rising over when the next missile launch will take place in North Korea

GETTYSpeculation has been rising over when the next missile launch will take place in North Korea GETTYA leading US thinktank has revealed the exact date for the next North Korean ballistic missile test

GETTYA leading US thinktank has revealed the exact date for the next North Korean ballistic missile test GETTYNorth Korea has not yet responded to the US re-designation of the regime as sponsors of terror

GETTYNorth Korea has not yet responded to the US re-designation of the regime as sponsors of terror