For example, at an investment conference in 1991 in Las Vegas with over 500 predominantly American investors in the room he predicted that China would be the next economic power of the world. He was booed off the stage shortly thereafter.

There’s no question in anybody’s mind that China is now the economic power of the world.

There’s no question in anybody’s mind that China is now the economic power of the world.In 1982 he predicted that “Hawaii real estate, which had seen a surge in previous years from Japanese investors was about to collapse”. Within a few short years it dropped 30% to 50%.

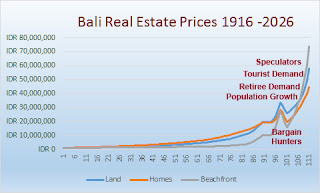

After moving full-time to Bali in 1996 he told friends and clients that “Bali’s real estate market was like Hawaii 30 years earlier” and that foreign investors would begin to invest after the dictatorship had ended.

In the following years prices of Bali real estate rose as much as 3,000% in as little as 12 years.

The day after Bali’s tragic bombings in 2002, while everyone was expecting a dramatic downturn in Bali tourism and real estate he posted that “Bali was still paradise and no act of terrorism would change that”.

Chinese Tourist Prediction:

His fellow hoteliers and travel agents laughed at this prediction. The Indonesian tourist bureau scolded him for making such a prediction.In 2017 that prediction came true.

| Bellefontaine speaking to 200 Travel Agents in Beijing 2008 |

In 2014 after Bali never having a real estate downturn in modern history he shocked most of his huge following on his Bali News & Views Blog when he predicted the worst downturn in history after a government minister warned foreign investors, who were utilizing nominee agreements, a grey area of law, that they were illegal.

Since 2014 Bali real estate prices have dropped as much is 50%.

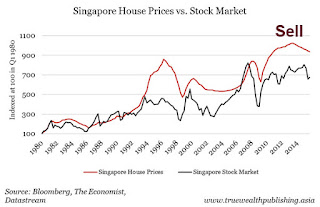

Singapore Real Estate Crash:

In the same year he predicted that Singapore real estate prices, which had soared with unconscious Chinese buying over several decades was about to end and that a real estate downturn had begun.

Since then Singaporean real estate has had almost four years of consistent downturn.

Over 65 % Accuracy:

Over the years he has made many predictions on investments such as precious metals etc. with over 65% of his predictions coming true.

Approximately 12 months ago he started to predict that Bali’s real estate downturn was over and that it was the second-best time to buy real estate this century.

Since then the market has leveled off and turned around. Bali Notaries and developers are beginning to see an increase in demand.

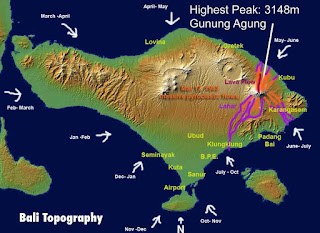

Accurately Predicted Mount Agung Effect:

In September 2017 when Bali’s Mount Agung Volcano erupted for the first time since 1963 he utilized his 21 years of experience in Bali with Trade winds etc. and predicted that although there may be eruptions “the trade winds would blow it away from the airport” and not cause many interruptions in tourist arrivals.

Since September the airport has only been closed three days due to abnormal cyclonic weather conditions drawing the winds from North to South as opposed to the normal seasonal Trade winds which flow from South to North and the Bali Airport has only been closed three days in four months.

Since September the airport has only been closed three days due to abnormal cyclonic weather conditions drawing the winds from North to South as opposed to the normal seasonal Trade winds which flow from South to North and the Bali Airport has only been closed three days in four months.He states, “although no one can predict the timing, size, magnitude or length of a future eruption he believes it will have little or no effect on Bali’s tourist arrivals or real estate demand in the long term”.

BIT Coin Crash:

Bellefontaine accurately predicted the recent bitcoin crash and warned friends, associates and readers to take their profits and get out for several months now. The last two days bitcoin has hit a new low and is now down 42% in just one month.

Nostradamus of Bali:

Nostradamus of Bali:His predictions have been so accurate that a very jealous major news letter publisher in Bali once called him the "Nostradamus of Bali".

As he explains, I am not a Nostradamus. “I don’t make any predictions based on supernatural visions of the future. I base my predictions first on 40 years of real estate and tangible investment experience, 21 years of living in Bali, 13 years of being president and director of 135 staff, TripAdvisor Hall of Fame award winning hotel”

He stresses that “predictions and investment decisions should be based on three major sources of information.

(1) Fundamental analysis of what is the current and future expected supply and demand?

(2) Technical analysis. Is the market oversold or overbought?

(3) Economic conditions. What are the current economic conditions and what are the economic conditions expected in the future?”

During a recent Christmas, New Year ski vacation in Canada, he digested daily input from Canadian and American television news stations.

World’s Economies - One of Best years This Century.

As he states going into 2018 we have the foundation for one of the best economies worldwide this century.

With unemployment rates in countries such as Canada, America, Germany,

Europe, and even Asia at near record low levels this means that everybody that wants to work is working.

People have much more money and confidence to purchase everything from homes to consumer items.

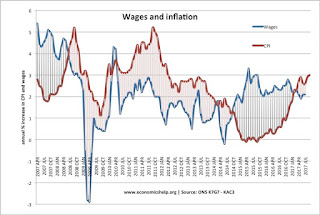

Higher Inflation Ahead:

Higher Inflation Ahead: He warns that, “record low unemployment may lead to higher inflation”. The Canadian government has just raised the minimum wage by almost 24% and large companies in America may follow suit.

He explains “Companies cannot provide substantial wage increases unless they’ve raise the price of their goods”.

As he points out “Also in the last six months oil prices have risen over 50% which means that gasoline and all oil related products will also rise.”

U.S. dollar will fall:

One of Bellefontaine’s major predictions for 2018 is that the U.S. dollar, which had started a downturn before Christmas will continue to fall in 2018 against many currencies such as the Euro, Canadian Dollar, Singapore Dollar, Australian and New Zealand dollars.

When prices start to rise for consumer goods people start to adopt the attitude I better buy it now before it goes up. Therefore, huge demand in a short time for consumer goods”.

Possible Much Higher Inflation in 2018:

Therefore, his first prediction for the world economy is an increase in inflation in 2018.

He reiterates that “inflation is like the tide it raises all boats.

He reiterates that “inflation is like the tide it raises all boats.It will cause tangible investments, (investments that you can touch and feel) such as commodities, real estate, precious metals, art, diamonds, numismatic coins etc., to increase at a rapid rate.

He warns that “Inflation can be your friend or your enemy. If you keep your money in a bank account earning 1 to 2% when inflation is 3 to 5% you will lose 2 -4%.

Bear Market in Bonds:

He cites the fact that “One major bond trader has just issued his first bear market signal for bonds in decades because as interest rates rise investors will want to sell their current bonds to buy higher interest bonds”.

Last Stage of Major Bull Market in World Equities:

Bellefontaine is predicting that, “In the first half of 2018 there could be a dramatic rise in world equities, especially U.S., Canadian and European stocks as the little person or small-time investor enters the market for the first time in a long time”.

He warns that “US equities indexes are already at the upper end of historic length of periods for stock markets.

The bull market that he predicted back in February of 2009 may end in the second half of 2018 or early part of 2019”.

As one article points out. “But the proverbial bull is also celebrating a milestone of its own: The bull market in U.S. stocks turns nine years old on Thursday, March 9.

The current bull market, defined by prices that continue rising without being interrupted by the 20% decline that would signify a bear market, began for the S&P 500 exactly nine years ago, in the depths of the recession in 2009.

Since then, the benchmark index has gained 249%, with just four official corrections—defined as a decline of 10% or more—the last of which happened in the beginning of 2016, according to Yardeni Research.

At 106 months old, this bull market is not the oldest in modern history (post-World War II): That title goes to the bull market that lasted from the fall of 1990 to the early spring of 2000, or 113 months, according to CFRA and S&P Global, before spectacularly flaming out in what has since become known as the dot-com bust.

That record dot-com bull market, which is also the best-performing, with a 417% gain, lasted just more than a year longer than the current bull market’s age. No bull market has ever made it to its 10th birthday.”

2018 Predictions for World’s Real Estate Markets:

One of Bellefontaine’s specialties the last 40 years is real estate. He is currently President, Dir. of 13 yr. old PT. B.A.L.I. who in the last few months launched a major high-tech website mirroring the largest real estate website in America.

He has a 90% + accuracy record on predicting major shifts in the worlds real estate markets since 1982, over 35 years.

He has a 90% + accuracy record on predicting major shifts in the worlds real estate markets since 1982, over 35 years.As he says, "one of the easiest markets in the world to predict his real estate because it doesn't change overnight. Real estate cycles usually last a minimum of three years and upwards to 20 to 30 years and the fundamental analysis of the markets is very easy".

As he says, “I came out of semi retirement because I believe that many Asian real estate markets, especially Bali, are going to surge in the next 3 to 10 years”.

Regarding the world’s real estate markets, America which he predicted would crash in 2007 and then predicted would start on another bull market in 2009 He says, “are getting old and mature”.

He is concerned about the fact that prices are starting to get to the point where not too many people cannot afford them, which is the first acid test for any real estate market.

So, although there may be one last sharp upturn in American real estate it may be short in length. Also, the markets may be killed when interest rates start rising substantially by the Federal Reserve in America to curtail higher inflation which is just around the corner.

So, for American real estate he is recommending holding at this point and look for an exit point sometime in 2018 or 2019.

He says, “the same is true of Canadian real estate which increased dramatically in recent years, primarily because of Asian buying”.

After just returning from a Canadian ski vacation he states, “Canadian real estate is now at the point where you cannot achieve positive cash flows.” He believes, “the Canadian market which he actually recommended and purchased for himself in 2009 is at the very last stages of a bull market and very dangerous”.

Many of the Western real estate markets are also in danger, especially Britain who because of it’s exit from the European economic Council is now seeing prices begin to fall in places such as London, which again is way overpriced.

Bellefontaine recommends selling in Canada, America, and London and buying in greener pastures which include several areas in Asia.

Most of Australian Real Estate Will Fall in 2018:

In the last couple years Bellefontaine became increasingly bearish on Australian real estate for the same reason that he became bearish on Singapore real estate three years ago. The buyers were not Australians but Chinese speculating on Australian real estate who did take into consideration whether they obtained a positive cash flow.

Singapore Real Estate Bear Market May End in 2018:

One of Bellefontaine’s most dramatic recent calls was predicting the end of a multi-decade bull market in Singapore real estate back in 2014. Since he predicted the downturn Singapore real estate has dropped as much as 30%.

But as he says, “there are signs that buyers are beginning to enter the market” although he still does not recommend Singapore real estate, due to low positive cash flows and a less than attractive economy.

As Bellefontaine says, “frankly I don’t know why anybody would want to live in Singapore, all it is one big shopping mall with few natural features to attract those wanting to retire”.

Speaking about retirement Bellefontaine points out that, “the largest demand for real estate throughout the world the next 5 to 10 years will be from baby boomers”. Boomers such as himself, born between 1940’s five and 1957 represent 25% of the world’s population and they are now retiring.

They will no longer need their big three-bedroom houses in places such as Sydney, America, Canada etc. because there is just the two of them. They now have opportunity to take their hard-earned cash and retire to a place where it’s a lot less expensive such as Bali, Vietnam, Thailand etc.

As he points out in his seminars if you look at Asia, which includes China, the largest country in the world, you can easily see that Bali is a short distance from every major country including Australia.

As he points out in his seminars if you look at Asia, which includes China, the largest country in the world, you can easily see that Bali is a short distance from every major country including Australia. There is an estimated 3 Billion people living within 5- 6 hrs from Bali. Twenty five percent of those are baby boomers about to retire.

If only 1 % of them decide to retire in Bali that will be almost twice the current population of Bali.

As Bellefontaine points out, "you don't have to be a rocket scientist to figure this one out. Bali is about to have relations largest increases demands in history the next five years".

This makes Bali a perfect spot for Asian expatriates to retire, where the cost of living is 50% to as much as 70% less than their own country. Not only can they can enjoy good clean air, fresh vegetables, warm year-round temperatures but most importantly the wives will not ever have to do any domestic chores again with housekeepers costing as little as $250 per month.

As Bellefontaine points out, “the main reason that he moved to Bali 21 years ago was the local Balinese people who are friendly and honest.

He even had his 79-year-old mother move to Bali and retire on one of Bali’s very attractive retirement visas. She ended her days living in complete comfort in her own private home, 10 minutes from the beach and a fraction of the cost it would cost in her former hometown of Victoria, Canada.

Below is a quick analysis of where Bellefontaine predicts will be the best and worst real estate markets in 2018 and the next 3 to 5 years.

(1) China’s major cities real estate prices will probably not grow much and may fall after years of extraordinary increases.

(2) Hong Kong, which Bellefontaine calls, “the bitcoin of the real estate markets because of it’s soaring prices with no reason” may for the first time in decades begin to crash, because nothing makes financial sense.

(3) Australia who also has enjoyed a robust real estate market for years has already seen the beginning of a downfall with places on the west coast of Australia in Perth dropping as much is 20% to 30% in a few short years. He predicts that now, “perhaps Perth prices have levelled off they may start to increase very slowly”. Not so attractive for investors.

(4) On the other hand, he’s predicting that most major Australian cities such as Sydney, Melbourne, Brisbane will see significant declines in prices in 2018 because they are simply overpriced for the market.

(5) Singapore which he accurately predicted would crash three years ago may have bottomed out and may only see minor increases in 2018.

(6) Thailand, Lagos. Cambodia, and Vietnam should have good real estate markets in 2018 and beyond.

(7) Indonesia with the fourth largest population in the world has an internal demand from simple population growth and should see continued increases in prices in most areas. Jakarta, its capital city may not see much increases due to over supply at this time but should not see a downturn.

(8) Bali, which has just endured the first downturn in modern history going back as much as 70 years or more has already had a four-year downturn.

With continued increases in tourist arrivals, especially from the Chinese who last year were up 57% Bali should see a robust real estate market this year.

Bellefontaine is predicting, “the beginning of a major 5 to 10-year rise, again primarily because of huge new demand from baby boomers” who will seek out Bali for its low cost of living, low cost of domestic help, fresh air, warm weather and friendly people. Bellefontaine believes that, “properties such as beachfront properties may see 10% to 15% increase in 2018 and a 50% to 200% increase in the next 5 to 10 years.

Bellefontaine recommends, “you start your search by attending one of his seminars coming up soon and learning everything about Bali from locations to buy what to buy where to buy etc.

You may also start your search with their very high-tech website bestasiarealestate.com which allows you to search areas without a keyboard.

As he concludes so long as you can still buy a three bedroom 500 m² villa with private swimming pool for as little as $159,000 which rents out for $3,000 to $4,000 per month there are still excellent opportunities in Bali.

Three bedroom 500 m² villa with

private swimming pool for as little as $159,000

Lawrence, his family and staff would like to wish everyone a very happy and prosperous new year.

First Free Bali Real Estate Seminars 2018

Are you tired of traditional investments such as banks and bonds that only offer 1-6% per year which do not keep pace with the real inflation.

Do you want to become rich the way over 60 % of self-made millionaires did?

According to PT. B.A.L.I., Bali's leading real estate expert for the past 13 years, who have thousands of satisfied clients, this is the “Second best time to purchase Bali Real Estate this century”.

They believe that recent changes in real estate laws for foreigners allowing them to obtain control for more than a normal lifetime and up to 70% bank financing is creating a huge new demand for Indonesian and Bali Real Estate.

Coupled with the fact that Bali Real Estate has just undergone the first correction in modern history with prices down as much as 50 % this has set the stage for *increases of 20% to 100 % the next three to five years.

Free Bali Real Estate Seminars:

Whether you are a buyer, seller, broker, agent, investor, lessor or renter you can benefit from attending one of our two free Real Estate Seminars in Bali this month.

At these seminars PT. B.A.L.I’s Canadian President, Lawrence, a 21 yr. Bali resident who is married to Azizah, a fully Licenced Notaris will review the most recent real estate laws for Indonesians and Foreigners in detail.

Then they will also discuss the Past, Present, and Future of Indonesian Bali Real Estate.

Free Seminar Schedule:

Bali, Emerald Villas, Jl. Karangsari, # 5, Sanur, Bali, Indonesia.

- Wednesday - Jan. 31st. 6:30 PM - 7:45 PM

- Saturday - Feb. 3rd. 2:00 PM - 3:45 PM.

- Thursday - Feb. 15th.. 6:30 PM - 7:45 PM

- Saturday - Feb. 17th. 2:00 PM - 3:45 PM.

At these seminars you will learn about:

- The Past, Present and Future of Bali and Indonesian real estate.

- Why a recent official clarification of foreign ownership laws allows foreigners to totally control Indonesian properties for up to 80 years without leases?

- Why Indonesian banks will now lend money on Indonesian Real Estate to foreigners, therefore proving leverage and additional huge profits?

- How to avoid legal problems and make sure a property is safe. How to avoid complicated real estate laws affecting Indonesians married to foreigners.

- Why this is the second best time to buy this century.

- Where are the best locations to buy for maximum profits?

- What type of properties will offer the best investment potential of *10% to 20 % per year?

- Discover how you can sell your property fast for the highest prices and lowest commissions on a brand new web site designed after the largest most successful real estate site in America with high tech search features.

- An opportunity for a free listing on B.A.R.E. First Class Beachfront property at almost 50% discount.

- A Quality 5,000 m2 Bali Hotel with 12 bungalows, 3 pools and Restaurant for only $588,000.

- Low cost properties with Luxury Villas starting as low as $138,000 for a three bedroom 650 m² 3 bedroom, 4 bath with private 9 mtr. Pool. Ridiculously low priced ocean view building lots starting as low as $25,000 for 500 m².

Free Parking. Seating is very limited for these free seminars so please avoid disappointment and make reservations A.S.A.P. Click Here For a Reservation

Or Email: seminarsptbali@gmail.com or Tel: Office: 62-361- 284069 For Bahasa English 62-8123814014 – Bahasa Indonesia or 62-8123632177

No comments:

Post a Comment